Cracking 409A Valuations: Selecting the Perfect Partner for all your Tax and Compliance Valuations In today’s dynamic startup landscape, attracting and retaining top talent often hinges on offering competitive equity compensation. But before issuing stock options or restricted stock units…

Understanding 409A Valuations and Their Importance in Equity Compensation Plans In today’s competitive talent market, attracting and retaining top performers often hinges on offering attractive compensation plans. Stock options, restricted stock units (RSUs), and other equity-based incentives are powerful tools…

The Growing Importance of Intellectual Property Valuation: Protecting Your Innovation’s Worth In today’s knowledge-driven economy, intellectual property (IP) has become a critical asset for businesses of all sizes. From groundbreaking inventions to creative brand identities, IP encompasses a wide range…

A Snapshot: Valuations of Non-Compete Agreements In today’s competitive business landscape, non-compete agreements have become increasingly common. These legal contracts restrict employees, business partners, or sell-side entities from engaging in competitive activities for a specified duration and within a defined…

Customer Relationship Valuation – Methods and Solutions In today’s highly competitive business landscape, companies are increasingly recognizing the significance of customer relationships as valuable intangible assets. Building and maintaining strong customer relationships not only drives revenue but also contributes to…

Complex Securities Valuations: Your Go-to Guide

Your Guide to Valuation of Crypto Assets Valuation of Crypto Assets – Introduction The world of crypto assets, with Bitcoin as its leader, is exploding both in terms of volumes and market capitalization. It’s also giving rise to numerous innovations…

A Deep Dive into the Valuation of Blockchain Companies Valuation of Blockchain Companies – Introduction In recent years, blockchain technology has emerged as a disruptive force across various industries, revolutionizing the way business transactions are conducted. From finance and supply…

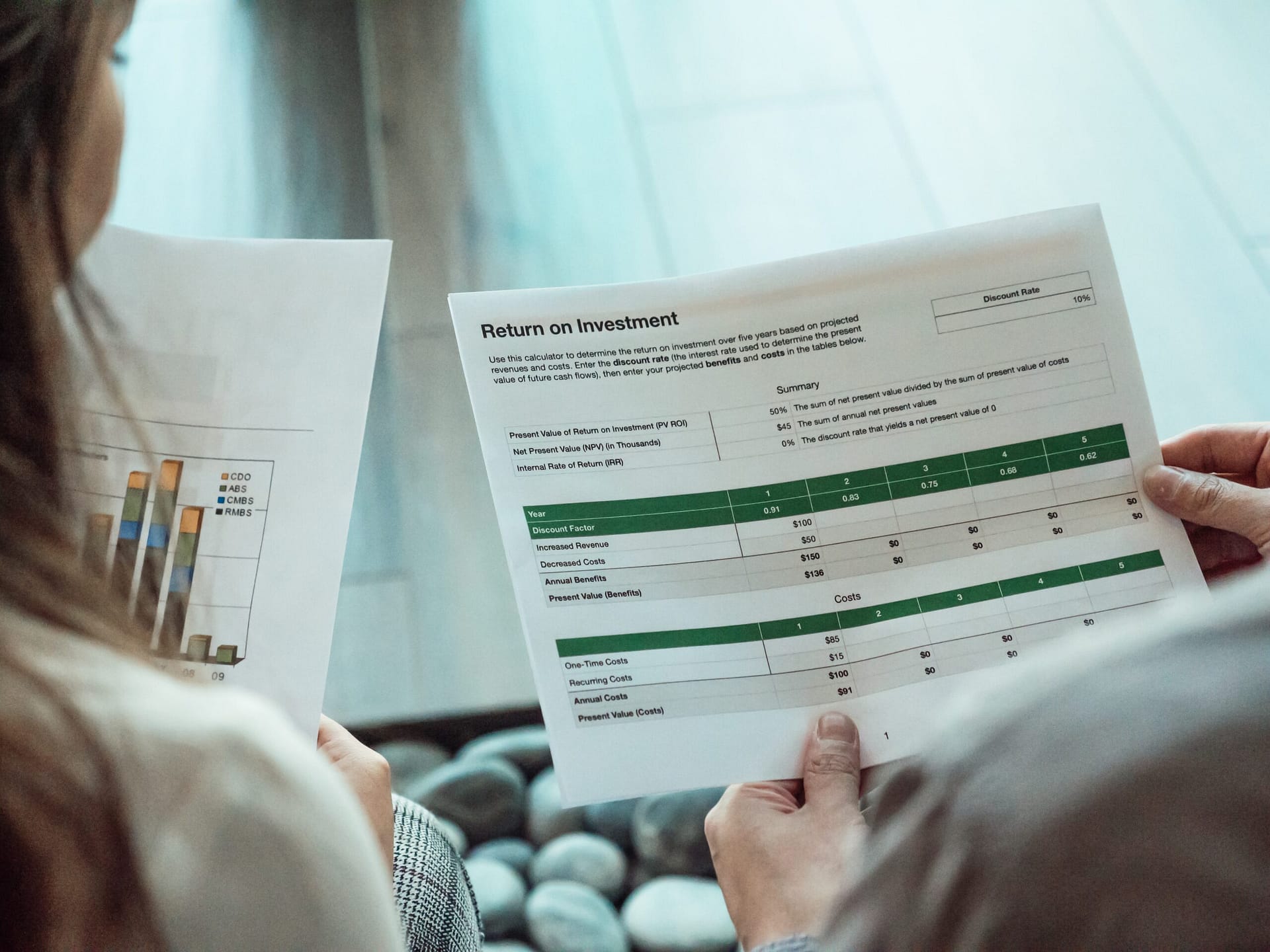

Portfolio Valuation – Case Study | ValAdvisor Portfolio Valuation – An Introduction Portfolio Valuation refers to the process of determining the worth or fair market value of a company or companies held within a portfolio, such as in a venture…

Importance of Contributory Asset Charges (CACs) in Valuation What are Contributory Assets Charges (CAC)? In the realm of financial reporting, understanding Contributory Asset Charges is essential for the accurate and transparent valuation of intangible assets in a business combination. When…